There is currently an unfixed bug in Quickbooks 2014 which Intuit doesn’t seem very motivated to fix. (It has been ongoing since October 2013 by some accounts.)

The bug involves Payroll Liability payments show as ‘unpaid’/’unprinted’ even after they have been submitted for E-Payment through Quickbooks payroll service.

This post gives a visual walkthrough on how I applied some of the comments on the link above to resolve the issue for our purpose.

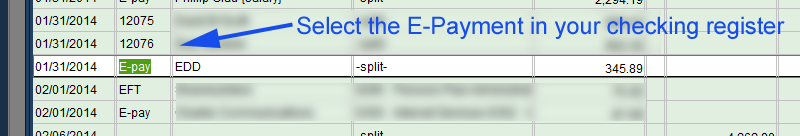

Step 1:

Find the e-payment in question in your register for which you are seeing the ‘unprinted’ checks reminder.

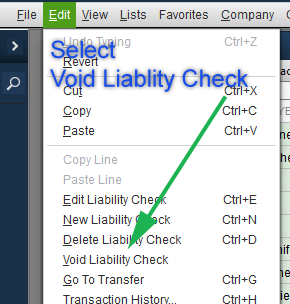

Step 2:

Void this E-Payment by either right-clicking and selecting “Void Liability Check” or from the Edit menu.

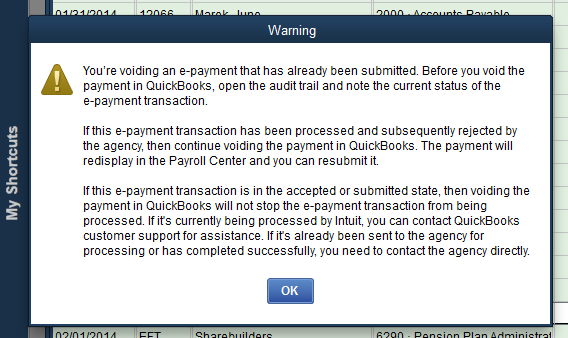

Step 3: Receive a warning from Quickbooks. I’m not 100% clear on when an E-Payment will or will not have been processed by Quickbooks, so I waited a couple days after the problem entry to resolve this error. That way I was guaranteed that the E-Payment was processed and sent to the government agency as expected. The last thing you want is for the E-payment to ‘actually’ be voided.

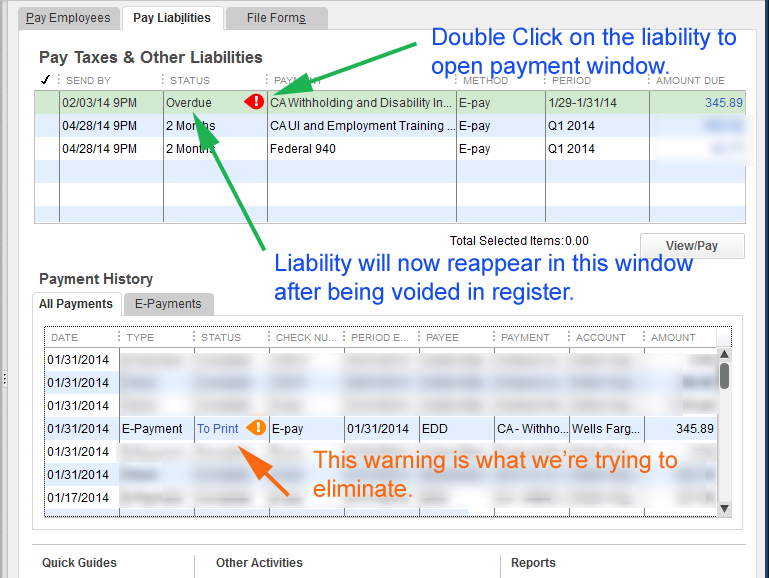

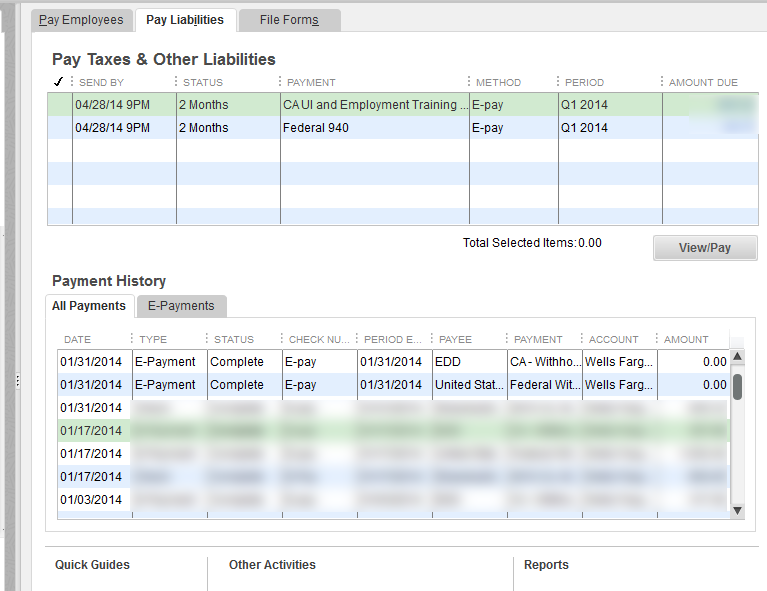

Step 4: The liability will reappear in your Pay Liabilities window.

Step 5: Double click the payment you just voided to open the Payment window. In my example, it says ‘overdue’, but that because I did it 5 days after submission and Quickbooks thinks it wasn’t ever made. Because the payment ~DID~ go through my bank account, I know that it isn’t really past due. The Payment History shows the “To Print” flag that we’re trying to get rid of due to the bug in Quickbooks software.

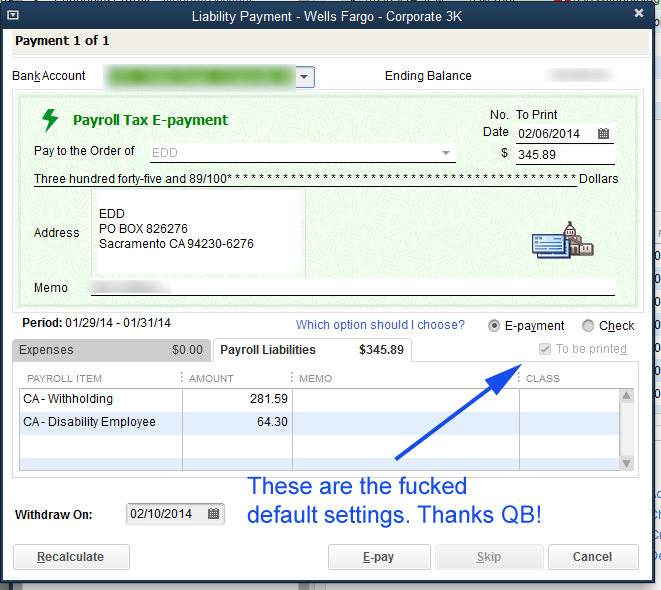

Once the payment window opens, you’ll see the fucked up default settings that are causing the problem. Notice how “E-Payment” is selected and “To Be Printed” is grayed out and ‘selected’.

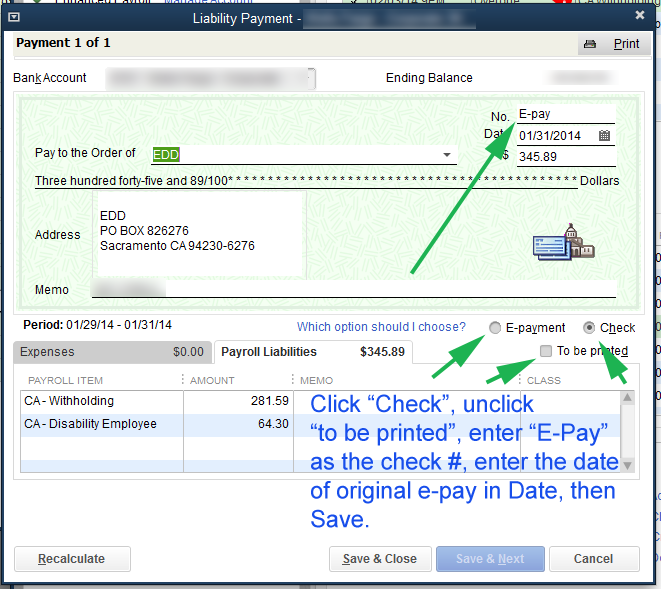

Step 6: Change the radio button from “E-Payment” to “Check”. This will allow the “To Be Printed” box to become active. Unselect the box. This will cause a check number to appear in the “No.” field at the top where it currently say “To Print” (top right corner.) Remove the check number it fills in and type in “E-pay” to indicate that it was in fact already e-paid.

I also like to change the date back to the same day I actually made the E-payment so that the voided transaction as well as this replacement one show up in the same place in the register.

Once you’ve made the changes “Save and Close” the payment. If you open the register that you just voided the payment out of, you should see this new replacement payment.

- Change settings to “Check” and deselect “To Be Printed”

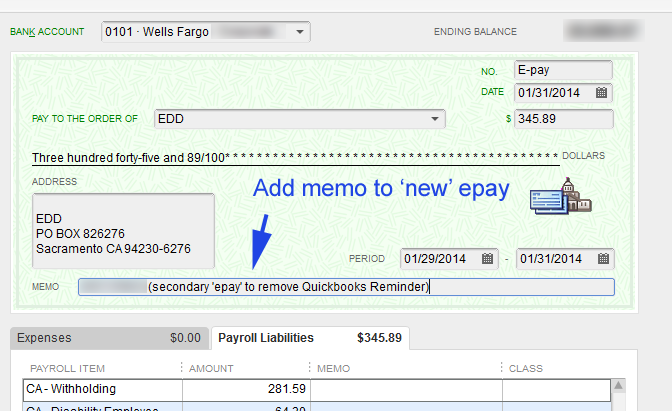

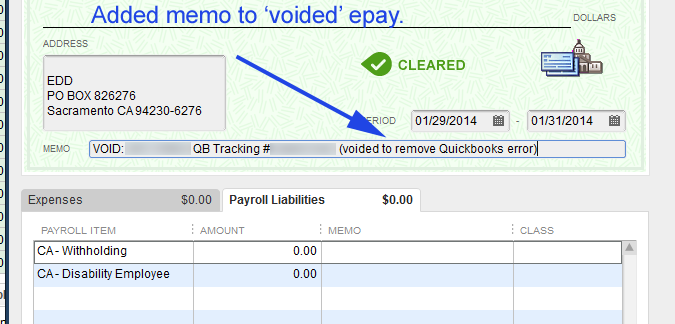

Step 7: I like to add memos to the voided payment and to the new payment to indicate why there are two transactions and why it looks like an E-Payment was voided. Will help anybody else who has to review the notes at some future date.

Step 9: In the Pay Liabilities window we no longer have the annoying and confusing warning that we need to print a liability check that was already e-paid.

Step 10: Visit Xero and seriously consider switching from Quickbooks. As soon as Xero figures out how to import historical Quickbooks data, I’m gone !!